(TBTCO) – The corporate bond market is showing signs of recovery, partly demonstrating the return of investor confidence, and at the same time, this also reduces capital pressure on the banking system while banks are under great pressure. in balancing short-term capital sources for medium and long-term loans.

|

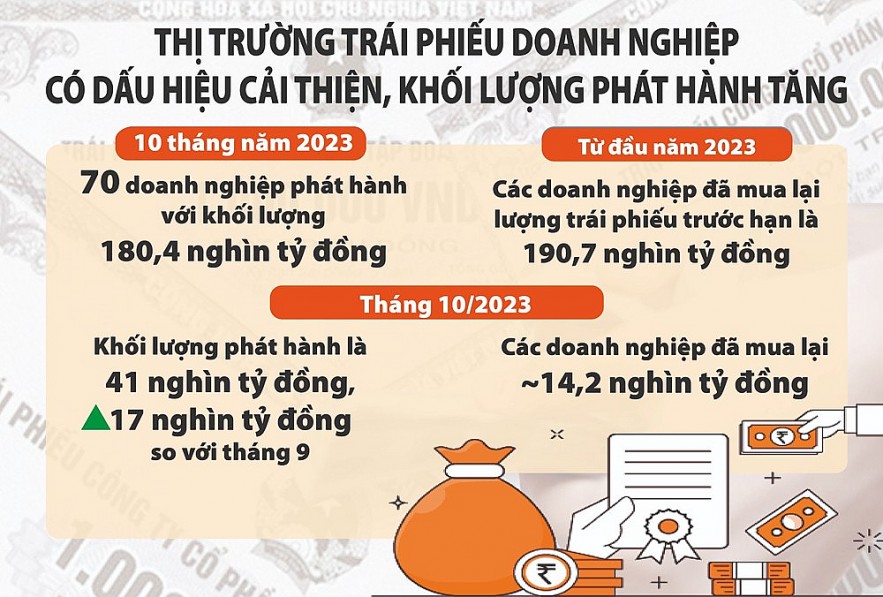

| Source: Ministry of Finance. Graphics: Phuong Anh |

Corporate bonds warm again

According to the Ministry of Finance, since the second quarter of 2023, the corporate bond market situation has shown signs of improvement, with issuance volume increasing. Specific data for 10 months shows that there were 70 businesses issuing with a volume of 180.4 trillion VND. In October 2023 alone, the issuance volume is 41 trillion VND, an increase of 17 trillion VND compared to September. Since the beginning of the year, businesses have bought back 190.7 trillion VND of pre-maturity bonds ( higher than the total issued). In October 2023 alone, businesses bought back about 14.2 trillion VND.

|

Effective capital mobilization channel for the economy In 2023, the Ministry of Finance will put into operation a separate corporate bond trading market to support market liquidity and enhance secondary market transparency. According to the State Securities Commission, the individual corporate bond trading system will develop stably and effectively, contributing to improving operational efficiency, development and stability of the stock market in general and the separate corporate bond market. retail sector in particular, creating an effective capital mobilization channel for the economy. |

According to the assessment of Mr. Nguyen Hoang Duong – Deputy Director of the Department of Banking and Finance, Ministry of Finance, the positive recovery of the corporate bond market is the resonance of both the Government’s drastic policies and the changes of the market participants.

In response to a number of law violations related to corporate bond issuance causing instability in the corporate bond market as happened last year, Government leaders have given many instructions to stabilize the macroeconomy. Solutions are provided on the basis of flexible management between fiscal policy and monetary policy, supporting businesses to restore production and business activities, and have cash flow to repay debt in general and corporate bond debt in particular. .

If counted alone since Decree 08/2023/ND-CP took effect (March 2023), the volume of corporate bond issuance reached 179.5 trillion VND. Mr. Do Ngoc Quynh – General Secretary of the Vietnam Bond Market Association said that Decree 08 was issued showing the Government’s interest and efforts in the development of the market.

Specifically, Decree 08 has established official legal frameworks to support genuine businesses in taking measures to restructure debt on the principle of voluntary agreements with investors to overcome difficult times due to economic changes. Objective and force majeure movements of the business environment. The extension of the application deadline for some new regulations is intended to help market participants have more time to prepare and adapt more effectively.

Reduce pressure on bank capital flows

|

The warming of the corporate bond market has somewhat reduced the pressure on capital needs for the economy, especially contributing to “reducing the load” on the commercial banking system.

Recently, businesses have also set high expectations for credit capital flows, especially, the City Real Estate Business Association. Ho Chi Minh City (HOREA) in the second half of November continuously sent two documents to the Government and the State Bank recommending many different issues related to credit for this sector.

One of the contents that HOREA recommends to the State Bank is to continue implementing Circular No. 02/2023/TT-NHNN on restructuring debt repayment terms and maintaining the same debt group to support customers facing difficulties in a certain period of time. certain period of time until the economy recovers and growth returns to normal. According to HOREA, this is to increase the “resilience” of businesses and have more opportunities to access new credit loans.

As for the State Bank, this agency has recently held many meetings with businesses to find optimal solutions to open up credit flows. However, on the other hand, the State Bank’s perspective is also quite cautious, especially real estate bad debt is also showing signs of increasing in the period from 1.72% at the end of 2022 to 2.89%. % by the end of the third quarter of 2023.

Meanwhile, the extension and repayment of debt according to Circular 02 has also been considered by some experts to be only a temporary solution because it essentially pushes risks into the future. In addition, commercial banks are also currently under pressure to balance and regulate capital sources because the ratio of short-term capital allowed for medium and short-term loans has decreased to 30% from the fourth quarter of 2023, replacing because of the 34% level like before.

Meanwhile, the actual capital needs for the economy are still very large. In a new dispatch issued at the end of November, the Prime Minister continued to request the State Bank to urgently review comprehensively the results of credit granting. . The Prime Minister requested the banking industry to ensure adequate supply of credit capital to serve the economy and the safety of the credit institution system, absolutely avoiding congestion, congestion, delays, or untimely events. In case there is content beyond authority, promptly report and propose to competent authorities according to regulations.

|

MR. NGUYEN HOANG DUONG – DEPUTY DIRECTOR OF BANKING FINANCE DEPARTMENT (MINISTRY OF FINANCE): Awareness of law enforcement has changed

The Government, ministries and branches have issued many policies to support businesses such as promoting administrative procedure reform for businesses, removing legal obstacles for real estate projects… As for other entities participating in the corporate bond market, after policies were issued synchronously, propaganda work about the corporate bond market was continued to be strengthened by the Ministry of Finance. Accordingly, the awareness and sense of compliance with the law of both issuing enterprises and service providers has changed strongly, understanding their responsibilities and obligations when participating in the market. This is a factor that helps the market become transparent and develop sustainably. In the coming time, the Ministry of Finance will continue to monitor and require businesses to allocate all resources to pay principal and interest on due bonds in accordance with the law, protecting the rights of investors. If businesses have difficulty making payments, they must work and negotiate with investors to agree on a bond restructuring plan. MR. RITESH MAHESHWARI – MANAGING DIRECTOR, IN RESPONSE TO SOUTHEAST ASIA (S&P GLOBAL RATINGS): The bond market is an important factor for capital allocation

In most economies, developing bond markets is an important factor in effectively allocating capital. In particular, the secondary market also plays an important role and for this market to be vibrant, it is necessary to have a diverse investor base and good liquidity. In the corporate bond market, information transparency is one of the important factors because it helps provide additional necessary information to investors, helps improve investment decisions and contributes to ensuring security. for the entire national financial system. As the investor base expands, credit rating activities and strict evaluation of issuers help investors assess the reliability of solvency and improve transparency. This is also a good means for leaders at all levels to find factors for improvement, which is increasing the depth of the bond market through assessment indicators of issuers, combined with analysis. Compare with similar businesses as well as other assets. |