(TBTCO) – Futures contracts maintained a downward trend in the derivatives market on December 14, but the decrease has narrowed significantly. Derivative market liquidity was almost unchanged compared to the previous session and was only at a relatively low level.

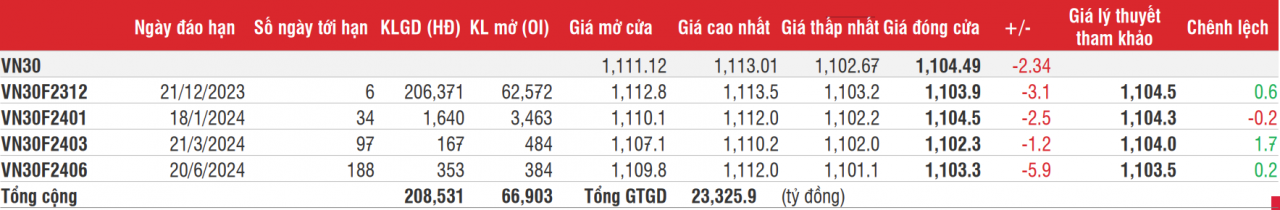

On the derivatives market on December 14, futures contracts closed in the red, although the decrease level has narrowed significantly compared to the previous session. The cautious mentality caused contracts to mainly fluctuate. At the close, the indexes decreased from -1.2 points to -5.9 points; Meanwhile, the base index also decreased slightly -2.34 points.

|

| The liquidity of the derivatives market did not change much compared to the previous session. Accordingly, the total futures contract trading volume reached 208,531 contracts. |

The current monthly contract VN30F2312 ended at 1,103.9, down -3.1 points compared to the previous session. The decrease in the December contract and the base index is almost the same, so the negative gap has not changed much compared to the previous session with -0.59 points.

The liquidity of the derivatives market did not change much compared to the previous session. Accordingly, the total futures contract trading volume reached 208,531 contracts, of which December contracts alone reached 206,371 contracts.

|

| Technical chart of contract VN30F2312. |

On the 1-hour technical chart, currently, the short-term downtrend of the VN30F2312 contract has not ended. Technical indicators such as the relative strength index (RSI) and moving average convergence divergence (MACD) agree on short-term negative signals. However, the support area of 1,096 – 1,098 points is also a strong accumulation area.

According to SSI Research, the VN30F2312 contract may adjust to approach the threshold of 1,096 points and recover slightly from here. It is recommended that investors can open a Long position at 1,096 points, cut loss below 1,093 points and take profit at 1,104 points.

On the base market, the VN30 index closed at 1,104.49 points, down slightly -2.34 points (-0.21%). Trading volume reached 155.3 million units, maintaining a higher level than average. The short-term adjustment trend in VN30 has not yet reached balance. Technical indicators such as RSI are neutral, the trend index (ADX) is in the declining strength zone. Thus, the short-term decline of the VN30 will continue to move down to the threshold of 1,098 – 1,099 points and may react positively to this threshold./.