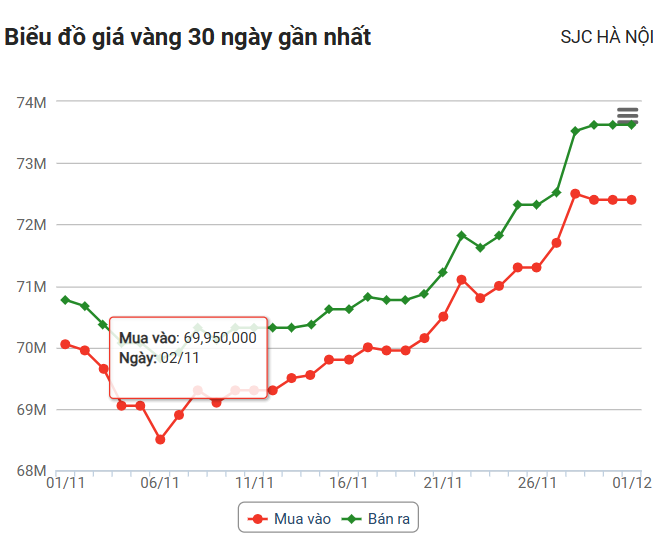

(TBTCO) – This morning’s trading session, world gold prices decreased by 7,451 USD/ounce compared to the previous session. Domestically, traders adjusted increases and decreases in opposite directions. In particular, there are brands that are still adjusted up to 74 million VND/tael.

|

| Source: Rong Viet Online Services Joint Stock Company VDOS – Updated at 06:46 (December 1, 2023). |

World market

Surveyed at 5:00 a.m. today (Vietnam time) according to Kitco, spot gold price was at 2,036,650 USD/ounce, down 7,415 USD/ounce compared to yesterday’s price.

Gold prices fell slightly as investors rushed to safety after the release of United States (US) inflation data. The core personal consumption expenditures (PCE) price index, the Federal Reserve’s (FED) preferred measure of inflation, rose 0.2% MoM and 3.5% YoY in October, meeting expectations while lower than September levels.

Financial markets welcomed the headlines, which were seen as a firm confirmation that the Fed would soon shift to a monetary policy rate cut.

Converted at the current exchange rate at Vietcombank, world gold costs about 58,875 million VND/tael (excluding taxes and fees). SJC’s gold bar price is still higher than the international gold price of 13,525 million VND/tael.

Domestic market

At the time of the survey at 5:00 a.m. this morning, the gold price on the trading floors was adjusted up and down by brands in opposite directions. Some brands still left the difference between the buying and selling price blank. As for Bao Tin Manh Hai’s SJC gold, it was adjusted to increase by 300,000 VND/tael on the buying side and 100,000 VND/tael on the selling side and maintain the mark of 74 million VND/tael on the selling side.

The specific prices of the companies are listed as follows:

JSC gold in Hanoi is listed at 72.4 – 73.62 million VND/tael (buy – sell).

DOJI Group’s 9999 gold is at 72.4 – 73.8 million VND/tael (buy – sell), increasing 200 thousand VND/tael on the buying side and 100 thousand VND/tael on the selling side.

PNJ gold brand is listed at 72.4 – 73.6 million VND/tael (buy – sell), an increase of 100 thousand VND/tael on the buying side and no adjustment for price difference on the selling side.

Vietinbank Gold brand is listed at 72.4 – 73.62 million VND/tael (buy – sell), no adjustment for the difference between buying and selling.

Bao Tin Minh Chau’s SJC gold is listed at 72.45 – 73.58 million VND/tael (buy – sell), down 50 thousand VND/buy tael and 100 thousand VND/sell tael.

SJC gold of Mi Hong brand listed at 72.3 – 73.3 million VND/tael (buy – sell) increased simultaneously by 200 thousand VND/tael in both directions.

Manh Hai’s SJC gold is listed at 72.5 – 74 million VND/tael (buy – sell), up 300 thousand VND/tael on the buying side and 100 thousand VND/tael on the selling side.

Forecast

Société Générale analysts said that although interest rates are high, strong demand for gold from central banks is the factor that helps stabilize gold and will continue to actively support the precious metal in the coming months. next time.

According to experts, gold will still benefit from safe-haven demand due to concerns related to geopolitical tensions.

Pushing prices above $2,000 is the start of a larger recovery that could push gold prices to about $2,200 an ounce in 2024, SocGen analysts said./.