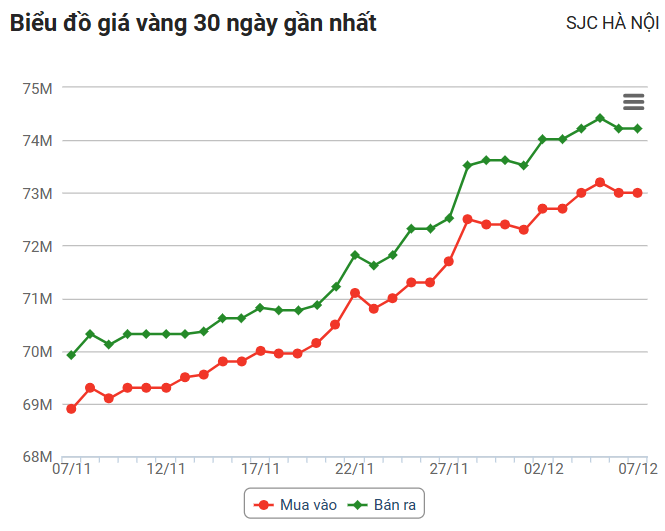

(TBTCO) – This morning, world gold prices increased by 8,615 USD/ounce after the announcement of weaker-than-expected US ADP employment data. Domestically, brands adjusted slightly downward, but prices remained largely stable above the 74 million VND/tael mark on the selling side.

|

| Source: Rong Viet Online Services Joint Stock Company VDOS – Updated at 06:48 (December 7, 2023) |

World market

Surveyed at 5:00 a.m. (Vietnam time), according to Kitco, spot gold price was at 2,027,755 USD/ounce, down 8,615 USD/ounce compared to the same time yesterday morning.

Converted at the current exchange rate at Vietcombank, world gold costs about 58,630 million VND/tael (excluding taxes and fees). Thus, SJC’s gold bar price is still higher than the international gold price of 14.37 million VND/tael.

Domestic market

In contrast to the rising momentum of world gold prices, at 6:30 a.m., on gold trading floors, brands adjusted the price of gold by 100 – 200 thousand VND/tael in both buying and selling directions. Only a few upstream brands adjusted slightly upward.

Specific prices of brands are as follows:

SJC gold in Hanoi was listed at 73 – 74.22 million VND/tael (buy – sell), down 200 VND/tael in both buying and selling directions.

DOJI Group’s 9999 gold is listed at 72.9 – 74.2 million VND/tael (buy – sell), an increase of 100 VND/tael in both buying and selling directions.

PNJ gold is listed at 73.2 – 74.3 million VND/tael (buy – sell), this brand has not adjusted the difference in buying and selling prices.

Vietinbank Gold’s SJC gold is listed at 73 – 74.22 million VND/tael (buy – sell), down 200 thousand VND/tael in both buying and selling directions.

SJC gold at Bao Tin Minh Chau was listed at 73.03 – 74.08 million VND/tael (buy – sell), down 170 thousand VND/tael on the buying side and 100 thousand VND/tael on the selling side.

At Bao Tin Manh Hai, SJC gold was also listed at 73 – 74.42 million VND/tael (buy – sell), down 200 thousand VND/tael in both buying and selling directions.

At Mi Hong Jewelry Company, SJC gold is at 73.2 – 74 million VND/tael (buy – sell), this brand adjusted to increase 200 thousand VND/tael on the buying side and there is no adjustment. Adjust in the selling direction.

Forecast

World gold prices increased slightly this session in the context of a falling USD and weaker-than-expected US employment data, reinforcing expectations that the Fed will stop tightening monetary policy.

Mr. Matt Simpson – Senior Analyst at City Index commented: “The volatility of gold prices may still be limited before the US non-farm payroll data is released.”

The precious metal rose to a record high of $2,135.40 an ounce in the first session of the week as markets placed high bets on a Fed rate cut, before falling more than $100 in the same session, citing uncertainty. about the timing of loosening monetary policy.

Currently, the focus of the business world is on US non-farm payroll data in November 2023, expected to be announced on Friday (December 8). The data will provide further clues about the interest rate outlook ahead of the Fed’s policy meeting next week.

According to CME’s FedWatch tool, traders are currently pricing in about a 60% chance that the Fed will cut interest rates by March 2024. Lower interest rates tend to support gold prices.

Besides, Mr. Wang Tao – Technical analyst of Reuters news agency commented that spot gold could increase to the range of 2,033 – 2,039 USD/ounce because it has stabilized around the support level of 2,009 USD/ounce. ./.