(TBTCO) – The bond market is still facing many challenges and has a rather slow recovery. However, this is essential for long-term sustainable and transparent development. In particular, the “taste” of investors in the market has had positive changes.

The market recovered slowly but in a positive direction

VBMA data compiled from the Hanoi Stock Exchange (HNX) and the State Securities Commission (SSC) shows that, as of the information announcement date October 31, 2023, the market in October recorded 18 individual corporate bond issuance, with a total value of 20,826 billion VND. Accumulated from the beginning of the year until now, the total value of corporate bond issuance recorded is 209,150 billion VND, including 25 public issuances worth 23,768 billion VND (accounting for 11.4% of the total issuance value). and 171 individual issuances worth VND 185,382 billion (accounting for 88.6% of the total issuance value).

According to experts, private placement is still the main form because in the context of the economy facing many difficulties and challenges, investors’ tastes have changed after major market fluctuations in the past. there. Although the market is recovering slowly, the successful issuance volume of more than 200 trillion VND is an encouraging number, especially when the market is entering a period of in-depth development, focusing on quality.

| As of October 31, 2023, the market in October recorded 18 individual corporate bond issuances with a total value of VND 20,826 billion. Accumulated from the beginning of the year until now, the total value of corporate bond issuance recorded is 209,150 billion VND, including 25 public issuances worth 23,768 billion VND (accounting for 11.4% of the total issuance value). and 171 individual issuances worth VND 185,382 billion (accounting for 88.6% of the total issuance value). |

In particular, investor psychology has changed significantly. If in the previous period, interest rates were the top concern when a part of investors massively poured money into high-yield bond lots, without paying attention to the business performance of the enterprise. Karma. Now, this has completely changed, investors are ready to buy bonds with interest rates 0.5 – 1% lower than the market but still ensure safety and a more attractive return than normal bonds. bank savings.

Accordingly, investors have paid more attention to the bond issuance consultant, the operating situation of the enterprise, including business indicators, financial indicators… Understanding the forecasts of experts , especially from reputable rating organizations, is also receiving more attention. The interest rate factor is no longer a key factor in investors’ decisions.

Investors focus on highly reputable bonds

In fact, corporate bonds are attracting many investors again recently and attention is focused on reputable distribution organizations, especially in implementing well their commitments to investors right in the future. the most difficult period.

Typically, at Techcom Securities (TCBS) in 2022, there have not been any bonds due to the consulting company that have delayed maturity and interest payments. In 2022, more than 75,000 billion VND in bonds and principal due for over 500 bond codes issued by TCBS as a consultant have been paid in full and on time. Accumulated in the first 10 months of 2023, TCBS has also made payments of more than 94,500 billion VND in bond principal and interest to investors.

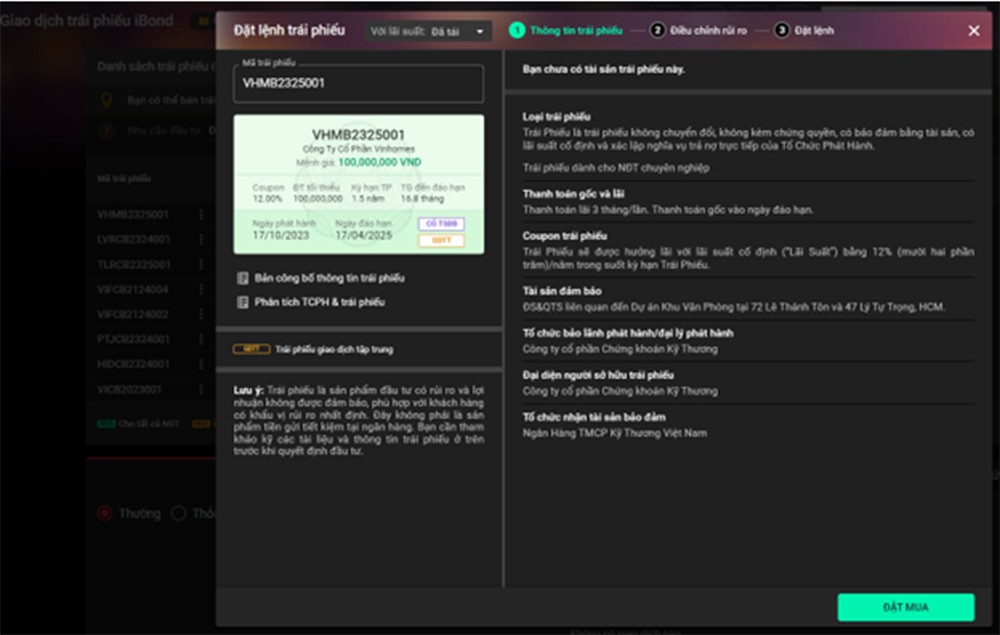

In 2023, TCBS launches iBond Protect bond with payment guarantee from Techcombank. In case the issuer fails to fulfill its obligations on time, the bank will be the guarantor of bond payment, fully paying bond principal and interest to bondholders. This is the most reputable form of assurance today for investors. Cumulatively from the product launch to the end of the third quarter of 2023, VND 7,344 billion of iBond Protect bonds have been successfully distributed to more than 2,565 individual customers.

|

|

TCBS launches the safe iBond Protect bond with 4 levels of protection. |

Experiencing major fluctuations in the market, TCBS is still the leading unit in terms of prestige and professionalism in the field of bond issuance consulting. With a strict risk appetite, TCBS only chooses to distribute bonds of leading businesses and corporations in Vietnam with healthy business operations and stable financial capacity, such as the bond group of Vingroup. , Masan Group,…

Besides, transparency of bond information for investors is also extremely necessary. Currently all information such as market update reports, interest period notices, payment dates, applicable interest rates, terms and conditions for buying bonds before maturity, and the last posting date for payment are available. Periodic profits, etc. are all announced by TCBS on the company’s website; At the same time, there are timely and quick notifications by email and text messages to customers.

|

| Investors are fully updated with transparent information about bonds on TCInvest. |

Because safety and transparency are given top priority, it is quite understandable that bonds distributed by TCBS are often not the bonds with the highest interest rates on the market. However, a lower interest rate of about 0.5 – 1%/year is not a problem in the eyes of investors today. An investment with an attractive enough return and a high level of safety is still considered better than a high return but lacking certainty.

Operating results in the first 9 months of this year also demonstrate investors’ confidence in TCBS in particular and in a professional and healthy investment environment for corporate bonds. Revenue from capital business and bond distribution in the third quarter of 2023 grew impressively by 134% compared to the previous quarter and 118% compared to the same period last year. TCBS is still maintaining the No. 1 market share in issuance consulting in the market with 61% (excluding bonds issued by banks)./.