(TBTCO) – Corporate bonds can be issued in two forms: public issuance or private issuance. While corporate bonds issued to the public require stricter requirements for the issuing organization, individual corporate bonds require higher requirements for investors. Accordingly, retail investors who do not have enough knowledge and ability to self-assess risks should only participate in buying and selling corporate bonds issued to the public.

|

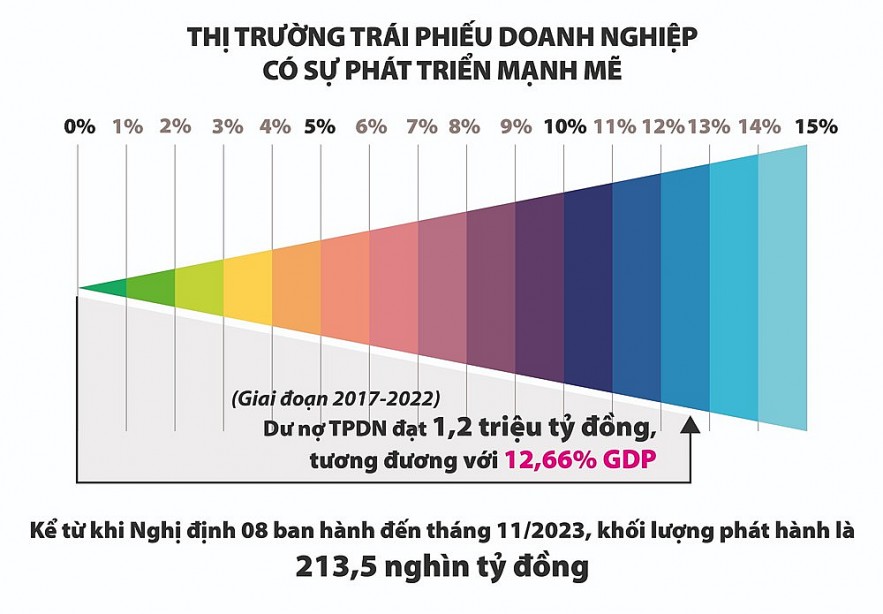

| Source: Ministry of Finance. Graphics: Phuong Anh |

2 forms of corporate bond issuance

Currently, corporate bonds are issued in two forms: private issuance and public issuance. Accordingly, each form is implemented according to its own legal basis. Corporate bonds issued to the public must comply with higher requirements on issuance conditions (shown in the Securities Law and Decree 155/2020/ND-CP guiding the Securities Law). Meanwhile, privately issued corporate bonds set stricter requirements on conditions for bond buyers.

For public issuance, the securities issuer must fully meet the general requirements for conditions for organizations offering securities to the public (including conditions for offering stocks and bonds). . At the same time, the offering registration dossier must be issued with a certificate of public bond offering by the State Securities Commission.

Meanwhile, privately issued corporate bonds are governed by Decree 153/2020/ND-CP (Decree 153), later amended and supplemented by Decree No. 65/2022/ND-CP (Decree 65 ) and Decree No. 08/2023/ND-CP (Decree 08). These decrees do not regulate the offering and trading of corporate bonds issued to the public in the domestic market. Among them, the most notable principle for privately issued corporate bonds is the flexibility and autonomy of the participating parties.

Specifically, businesses issue bonds according to the principle of self-borrowing, self-payment, taking responsibility for the efficiency of capital use and ensuring the ability to repay debt. Meanwhile, for investors, Decree 153 and Decree 65 both stipulate: “Investors self-assess, are responsible for their own investment decisions and bear the risks arising in making their own investments.” bond investment and trading”.

After that, Decree 08 issued in March 2023 allowed the suspension of some regulations in Decree 65 and Decree 153 on a number of contents: regulations on determining the status of professional securities investors is personal; regulations on bond distribution time of each issuance; regulations on credit rating results for bond issuing enterprises.

Awareness of investor responsibility

|

Mr. Nguyen Hoang Duong – Director of the Department of Finance of Banks and Financial Institutions (Ministry of Finance) said that the Ministry of Finance submitted to the Government to promulgate Decree 08, which contains content to temporarily postpone the implementation of a number of regulations. of Decree 65 so that businesses have more time to handle immediate difficulties related to bonds; contributing to reducing liquidity pressure and gradually restoring confidence to the market.

Regarding time according to Decree 08, the contents of Decree 65 and Decree 153 are no longer effective until December 31, 2023. According to the assessment of a number of independent financial experts, Decree 08 issued at that time demonstrated the Government’s interest and efforts in the development of the market, supporting genuine businesses with effective measures. Debt restructuring methods to overcome difficult times due to objective fluctuations.

However, commenting on the temporary suspension of some contents (without completely abolishing them), Mr. Do Ngoc Quynh – General Secretary of the Vietnam Bond Market Association said that the spirit of the Resolution Decree 65 is the inheritance of previously issued policies and decrees to guide the market towards more transparent, professional and sustainable development.

Accordingly, the general spirit of privately issued corporate bonds differs from corporate bonds issued to the public in the requirement for investor professionalism. Accordingly, the Ministry of Finance has continued to recommend that service providers be responsible for improving service quality; Absolutely do not invite investors who do not meet the conditions to become professional stock investors to buy bonds.

Meanwhile, the current Securities Law also has very specific regulations on financial capacity and experience requirements for professional investors. These must be financial institutions (banks, finance companies, insurance companies, securities companies, investment funds…).

Investors must be enterprises with actual contributed charter capital of over VND 100 billion or listed organizations or organizations registered for trading. In case the investor is an individual, he or she must have a securities practice certificate, or the investor must hold a securities portfolio with a minimum value of VND 2 billion, or the most recent year’s taxable income must be at least 1 billion.

|

Temporary difficulties in the corporate bond market are gradually being resolved In the period 2017-2022, the corporate bond market has developed very strongly with outstanding corporate bond debt reaching 1.2 million billion VND, equivalent to 12.66% of GDP. However, in the period of 2022, a number of businesses issuing for wrong purposes and showing signs of violating the law are being handled by the authorities. Meanwhile, some other businesses have difficulty with liquidity due to objective factors of the economy. Faced with that situation, the Government and the Prime Minister have issued drastic and timely instructions to promulgate Decree 65 and Decree 08 to strengthen market management, improve the quality of corporate bonds, and at the same time remove regulations. hard. |