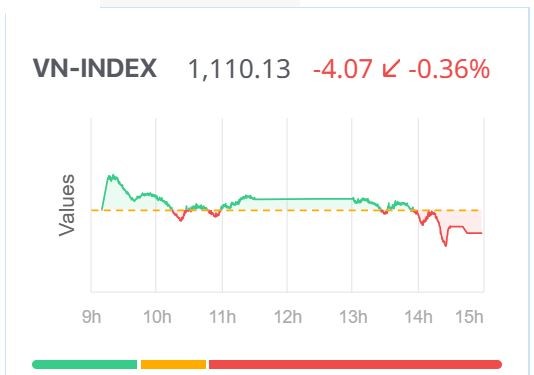

(TBTCO) – The stock market today (December 14) continued to adjust for the second consecutive session from the peak in November. The VN-Index’s movements repeated yesterday’s session, when downward pressure occurred in afternoon session and ending session “light red”. Liquidity decreased in the context of foreign investors still net selling, but the intensity decreased compared to yesterday.

Struggling within a narrow margin

The stock market today continues to fluctuate within a narrow range. Investor sentiment is still quite cautious despite positive information from the FED helping the global stock market increase sharply. Domestic investors are not very excited about world stock developments, even though at its highest point the VN-Index surpassed the 1,120 point threshold.

Closing today’s trading session, the VN-Index decreased -4.07 points, to 1,110.13 points. Statistics on HOSE, today there are only 138 codes increasing, 85 codes remaining unchanged, while there are 384 codes decreasing. Regarding stock groups, the downward pressure was widespread so there was no stock group that went upstream today, however the market still remained at the 1,100 point threshold thanks to the efforts of some banking stocks such as: VCB , ACB, TCB…

|

| Major stocks that put pressure on the market this session include: VHM (-1.1%), HPG (-1.1%), VPB (-1.04%), NVL (-4.12%) , SAB (-1.56%)… On the contrary, large stocks supported the market including: VCB (+0.84%), FPT (+1.05%), ACB (+0.9 %), VNM (+0.29%), ACG (+3.05%)… |

The VN30 group also adjusted down on a large scale. Closing today’s session, the VN30 index decreased -2.34 points (-0.21%), to 1,104.49 points. Market breadth recorded 7 stocks increasing, while there were 17 stocks falling and 6 stocks remaining unchanged. Stocks such as: HPG, VPB, STB, MSN, VHM… became a drag for this group of stocks.

On the Hanoi floor, the two main indexes moved in opposite directions. Meanwhile, the HNX-Index retreated -1.19 points (-0.52%), closing at 227.23 points; UPCoM-Index increased +0.13 points (+0.15%) to 85.22 points.

Whole market liquidity was 16,918 billion VND, down 20.9% compared to yesterday’s session. According to statistics, liquidity since the beginning of this week is 26.8% lower than the average level last week.

Foreign investors continued to net sell -354 billion VND on HOSE. In particular, the selling force focused on codes, including: CTG (-48.3 billion VND), STB (-45 billion VND), VPB (-36.8 billion VND), HPG (-35.5 billion VND) … Meanwhile, foreign investors were net buyers on the HNX with a value of +35.2 billion VND.

Waiting for the actions of ETF funds in the weekend session

The reaction of the domestic stock market today was actually a bit disappointing. World stocks are “green” after the FED sent a soft signal, marking the first time in this tightening cycle that the world’s most powerful central bank acknowledged positive developments in inflation.

The main reason is said to be the cautious reaction of cash flow to wait for developments in the portfolio restructuring session at the weekend session of ETF funds. Liquidity today decreased quite sharply when the matched order value on HOSE was only over 12,000 billion VND. However, it is forecast that market liquidity will increase in tomorrow’s session and cash flow is expected to participate when ETF funds will sell more.

|

| The market remains cautious despite positive news from internationally. Illustration. |

From a certain perspective, buyers have reasons to leisurely buy. Even in today’s session, the morning cash flow was quite “sluggish” when the market was slightly green, only in the afternoon session, when the selling force increased, accompanied by a decrease in price, did the buying become more exciting. Besides, after a series of strong net selling sessions, domestic cash flow will wait until it rebalances before starting to launch.

Technically, although the VN-Index decreased for 2 sessions from its peak in November, it is still in the trend of fluctuating in the accumulation zone over the past month, continuing as long as the support area around 1,080 points is not violated.

A volatile session at the end of the week is not beyond investors’ expectations. The domestic market is forecast to return to equilibrium next week and external supporting information will be revalued./.