(TBTCO) – Although lending interest rates have decreased, the requirement of the Government and the State Bank (SBV) is to continue to manage credit growth reasonably and further reduce interest rates to better support the economy. international. Accordingly, commercial banks have tried to implement solutions, including promoting payment services to attract demand deposit flows to reduce capital mobilization costs.

|

Continue to request interest rate reduction

According to the State Bank, the current lending interest rate has decreased by about 2 – 2.5% compared to the end of 2022. However, this reduction still does not meet the expectations of businesses and people, and also as required by the National Assembly and the Government.

In the recently stated requirements and goals, the Prime Minister and the State Bank continue to set the goal of further reducing interest rates. Specifically, the Prime Minister still requires the State Bank to direct credit institutions to more drastically implement measures to continue reducing lending interest rates. Banks promote the effective implementation of preferential credit packages suitable to the characteristics of each credit institution in important fields and growth drivers of the economy according to the Government’s policies.

As for the State Bank, this agency also said that in the year-end period, it will continue to closely monitor market developments to promptly regulate credit growth from banks with surplus to banks with insufficient limits, ensuring capital supply. credit for the economy, contributing to solving difficulties in production and business, promoting economic growth. In addition, one of the solutions is to continue to simplify loan processes and procedures, publicize fees, interest rates… to create more favorable conditions for businesses and people to access bank credit capital. row.

The next solution is to promote dialogue and connection between banks and businesses to increase propaganda information, grasp needs, promptly handle difficulties and obstacles in credit relations, and create favorable conditions for customers. Favorable conditions in accessing credit capital for people and businesses. Especially on the issue of interest rates, the leader of the State Bank said that this agency will direct credit institutions to reduce costs to reduce lending interest rates and cut fees to support businesses and people.

Promote payment services

|

In the request to reduce interest rates, the Government also sets specific requirements such as: Cost reduction, simplification of administrative procedures, increased application of information technology, digital transformation… Accordingly, the Promoting technology application and developing payment services is considered by banks as one of the solutions to increase the proportion of demand deposits (deposits that pay very little interest).

In fact, recently, one of the reasons why banks have reduced savings deposit interest rates to a fairly low level, but lending interest rates still decrease more slowly than savings interest rates due to the impact of the “interest fever”. interest rate” in the late 2022 and early 2023 period. The deposit mobilization interest rate for a period reached over 11%, then in early 2023, although it decreased, it was still at about 8 – 9%. Accordingly, some people’s long-term deposits continue to be affected to the present because their savings books have not yet matured, meaning that banks still have to pay interest to people according to the interest rate on their savings books. .

In the current context, promoting payment services is considered a solution not only in the short term, but also in the long term to help banks reduce capital mobilization costs through increasing the CASA (Current Account Savings Accoun) ratio. . This is the amount of money that customers actively deposit in a demand account at the bank, in order to be ready for spending and payment needs, although the benefit rate is quite low, only about 0.1%/year.

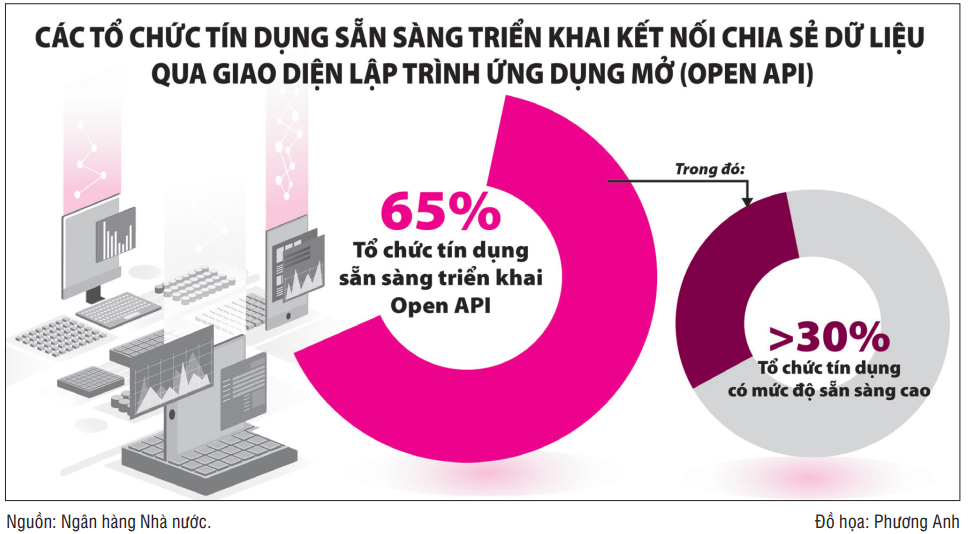

One of the breakthrough technologies associated with the 4.0 industrial revolution, allowing connection and data sharing via open application programming interface (Open API), has been researched and applied by a number of Vietnamese banks. payment activities, electronic customer identification, and provision of innovative financial products and services. Open Banking – Open API is a new field in terms of both technical and legal factors not only in Vietnam but also in the world. According to the State Bank, the implementation of the legal framework for Open API will create conditions for the Fintech community to provide new innovative services, meeting the increasing needs of customers to keep up with developments in service provision. bank.

Mr. Pham Anh Tuan – Director of the Payment Department of the State Bank said that up to now, 65% of credit institutions are ready to deploy Open API, of which over 30% of credit institutions have a high level of readiness for Open API. API. Many credit institutions have built application interfaces that allow third parties to connect so that partners can participate in the banking ecosystem.

|

Risk protection solutions Mr. Tran Quang Hung – Deputy Head of the Information Security Department, Ministry of Information and Communications, said that the financial infrastructure of financial institutions and banks, including payment systems and websites, must be protected safely, without interruption or affecting users. The system must also be designed to have the fastest recovery ability even when problems occur; Banks must comply with legal regulations on ensuring information security and fully implement information security measures according to regulations of state management agencies. In addition, banks need to cooperate closely with competent authorities, government agencies and other relevant parties on information security, forming a trusted network to work together to deal with threats. challenges and taking advantage of opportunities in the context that the whole country is promoting digital transformation to accelerate development. |