(TBTCO) – At the 28th Conference of Parties to the United Nations Framework Convention on Climate Change (COP28), VietinBank met bilaterally with major partners MUFG, Standard Chartered and Goldwind with the goal of: Joining hands to promote Climate finance in Vietnam.

Sustainable development has been of interest to VietinBank since very early on and has taken specific actions to integrate sustainable development into the bank’s operations. VietinBank’s sustainable development funding growth rate in the period 2018 – 2022 always reaches 100% annually.

The environmental, social and governance report conducted by HOSE in 2022 assessed VietinBank’s score at a high level compared to the banking industry average; Of which, the score for environmental criteria reached 87%, the score for social criteria reached 92% and the score for governance criteria reached 85%. Recently, VietinBank also signed a cooperation agreement with the Ministry of Natural Resources and Environment to coordinate in promoting sustainable development in Vietnam.

Participating in COP28, VietinBank held bilateral meetings with major partners: MUFG, Standard Chartered and Goldwind to: Join hands to promote climate finance – one of the four cross-cutting focuses of COP28.

Share experiences on sustainable finance

Sharing experiences on sustainable finance is one of the contents discussed at the bilateral meeting between VietinBank and partners at COP28. In the context of sustainable finance in Vietnam, which is in the early stages of development, it is important to research and learn from experiences from large, reputable, multinational financial institutions with extensive experience in the field. Sustainable finance is essential.

|

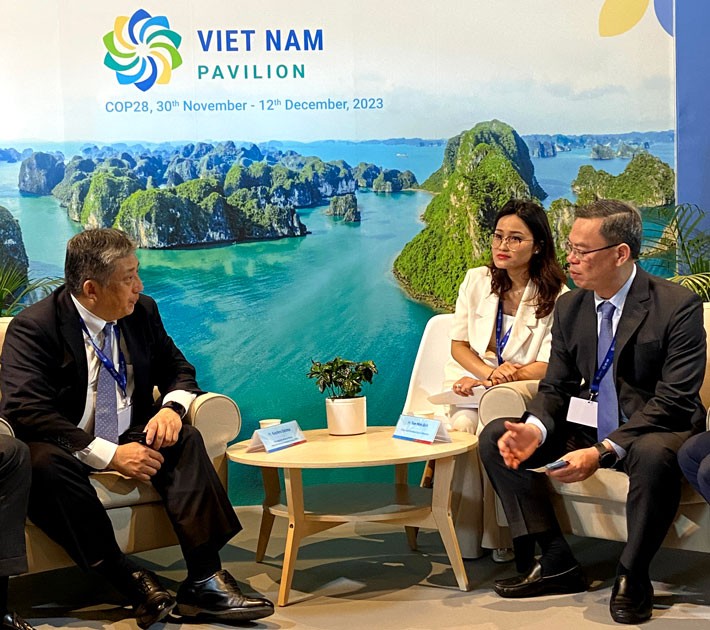

| VietinBank Chairman of the Board of Directors Tran Minh Binh and Mr. Koichiro Oshima – CEO, Director of Financial Solutions Business Unit, MUFG (left) discuss cooperation opportunities in the field of sustainable finance. |

In addition, the following contents: The situation of sustainable financial markets in the world; carbon credit market; Policy updates of countries that can impact the bank’s strategies and operational plans in the field of sustainable development… are also shared and discussed at bilateral meetings.

|

|

VietinBank Working Group and Standard Chartered Working Group at the bilateral meeting within the framework of COP28. |

Currently, VietinBank is building a Sustainable Finance Framework, to provide specific guidelines for financing and managing sustainable development grants.

Join hands to mobilize sustainable capital

Vietnam, with more than 3,200 km of coastline and many provinces, cities and river deltas with low-lying terrain, is one of the most vulnerable countries in the world to climate change. According to the National Report on Climate and Development for Vietnam released by the World Bank, it is expected that Vietnam needs to invest about 6.8% of GDP, equivalent to 368 billion USD from now to 2040 to implement the roadmap. climate adaptation and net zero emissions.

Therefore, financial resources from banks are not only an important capital channel for the economy but also a lever to promote the transition to a circular economy with zero net emissions.

|

|

Mobilizing capital for sustainable development is one of the focuses of the bilateral meeting between VietinBank and MUFG at COP28. |

Cooperation to arrange capital mobilization for green projects and projects that benefit society is also a focus discussed in bilateral meetings between VietinBank and partners MUFG and Standard Chartered. In particular, MUFG will make efforts to support VietinBank in arranging capital financing of up to 1 billion USD for sustainable development financing.

Cooperation for sustainable development

Currently, VietinBank has developed specific products for the field of sustainable development such as: Financing solar power and wind power projects; Preferential funding packages for sustainable fields such as renewable energy, green construction, green exports…

In addition, VietinBank continues to research to build new products and services such as: Sustainable lending; sustainable linked loans, green bonds, ESG roadmap consulting… At bilateral meetings, VietinBank exchanged cooperation opportunities and business ideas for sustainable development, especially in in the field of wind power with Goldwind when Vietnam is considered a country with extremely large wind potential.

|

|

VietinBank and Goldwind discussed cooperation to promote wind power energy in Vietnam. |

With a commitment to accompany customers in converting to net zero emissions, VietinBank is constantly looking for opportunities to cooperate with partners with extensive experience in the field of sustainable development, thereby building foundations. essential for sustainable finance and better support customers on the journey towards a circular economy./.