Bear market is a common term when you participate in the stock market, it tells you the market situation in different periods.

A bear market refers to a market state characterized by falling stock prices and pessimistic investor sentiment. Typically a bear market is identified when the prices of assets experience multiple declines; if security prices fall by 20% or more from their previous peak, investors will consider it a bear market. bear market.

1. What are Bull markets and Bear markets?

Bull market also known as a bull market refers to an economic state in which the price of a traded commodity is on an upward trend, typically classified as a price increase of at least 20% since the most recent bottom. Typically this term is often used in the stock market however it can apply to anything that has a price that is traded in the market, including bonds, real estate and even currencies.

In contrast to Bull market, Bear market also known as bear market, Bear market refers to a market state characterized by falling stock prices and pessimistic investor sentiment. Typically a bear market is identified when the prices of assets experience multiple declines; if security prices fall by 20% or more from their previous peak, investors will consider it a bear market. bear market.

.jpg)

Bear market and Bull market in stocks

During a bear market, investors are not confident that the market will experience a bull run anytime soon, and so many will sell off their stocks to avoid losses while prices fall. As more investors sell, the stock price will fall and create a cycle that pushes prices down even more.

2. How to distinguish bear markets and corrections.

A market correction is a decline in the market price of a stock or index that is greater than 10%, but less than 20%, from its most recent peak. Normally, a correction market and a bear market have the following differences:

Percent decrease

The main difference between a correction and a bear market is the percentage decline in price from the previous peak. Normally, a decrease of 10 to less than 20% can be considered a market correction. On the other hand, a bear market is when the market declines at least 20% since its previous peak.

Time frame

Price adjustments are unpredictable, rarely lasting over a long period of time. In contrast, bear markets typically last as little as two months and can last for years.

Regularity

Correcting markets tend to occur more frequently than bear markets. You may see some market correction in a bull market before the market has a more significant downturn into an extended bear market with sharper declines.

Recovery time

With a bear market, because the decline is more severe and lasts longer, a bear market usually takes longer than a market correction to recover to the previous high.

.jpg)

Bear market in stocks

3. How to invest in a bear market

Average price

Suppose the price of stocks in your portfolio falls 25%, from $100 per share to $75 per share. If you have money to invest and want to buy more of this stock you can try to buy when you think the stock price has dropped.

The problem is, you’ll probably be wrong. That stock may not bottom out at $75 a share; rather, it could fall 50% or more from its high. This is why timing the market or fishing the bottom is a risky endeavor.

A more conservative approach is to periodically add funds to the market through a so-called strategy price averaging strategy. Averaging is when you continue to invest roughly the same amount over time. This helps level out your purchase price over time, ensuring that you’re not putting all your money into high-priced stocks (while still taking advantage of market declines).

Diversify your investment portfolio

Diversify your investment portfolio is to invest in different securities and establish a reasonable asset structure to diversify risks. Diversifying a stock investment portfolio does not completely eliminate all risks, but risks can be minimized according to the principle of “Don’t put all your eggs in one basket”.

Because bear markets often precede or coincide with economic downturns, investors often prioritize assets that, during these times, offer more stable returns. Such assets can include:

+ Dividend paying stocks: Even if the stock price doesn’t increase, many investors still want to be paid dividends. That’s why companies that pay higher-than-average dividends are attractive to investors during a bear market.

+ Bonds: Bonds are an attractive investment during times of volatile stock markets because their prices often move in the opposite direction of stock prices. Bonds are an essential component of any investment portfolio, but adding high-quality, short-term bonds to your portfolio can help ease the pain of a bear market.

Invest in industry groups that perform well during recessions

If you want to add some stable assets to your portfolio, look to industries that tend to do well during market downturns. Things like staples and consumer conveniences often withstand the market better than others.

Focus on the long term

The bear market tests the resolve of all investors. While these periods are difficult to survive, history shows you probably won’t have to wait too long for the market to recover. And if you’re investing for a long-term goal — such as retirement — the bear market you endured will be overshadowed by the bull market. You should not invest in the stock market.

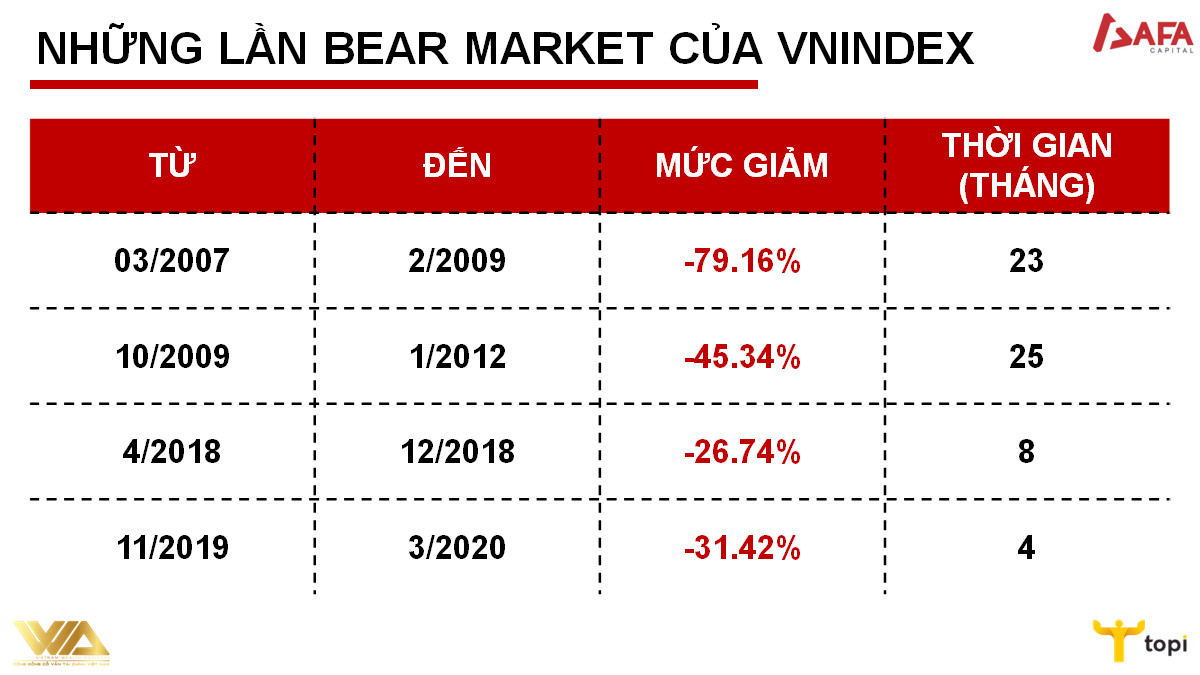

4. The times when Vn Index entered the bear market

Average reduction of VNIndex in bear markets from 2001 to 2018 it was about 49%. And the average duration is 16 months. The duration of the bear market has tended to decrease since 2007.

.jpg)

5. Mistakes to avoid in a bear market

Sell off stocks in panic

Because they were so scared, many people, even though they didn’t want to, had to sell off stocks when they fell. If you do it that way, you’ll definitely cut your losses, but if you wait for things to settle down, those stocks will likely recover soon. Therefore, invest with a “buy and hold” approach with quality stocks for many years. If you adopt that mindset, you may be less likely to panic when stock prices temporarily dip.

Heard from too many people

When the market crashes, there will certainly be a lot of people giving advice, and some of them may not even be qualified. You’ll also find many valuable tips and expert advice online. However, you need to form a strategy that works for you, based on your investment portfolio.

There is no stop loss

Having an exit strategy when the market goes down will definitely help you minimize possible losses. Choose your stop loss after doing your research on the company and its stock. Of course, these strategies won’t work without discipline. Having clarity and making informed decisions is crucial in such times.

Try to catch the bottom

It’s best not to make assumptions about the bottom of an index or stock. While one can look at support levels during a bear market, one should not get too caught up in making predictions. Make your decision based on what’s best for your portfolio.

Above is all you need to know about a bear market, hopefully with the above knowledge, TOPI can help you identify what a bear market is and how to behave in this market.