(TBTCO) – According to the general trend, foreign investors continuously sell net on the domestic stock market, however compared to other countries, their net selling value in the Vietnamese market is low. Foreign investors’ net selling from the beginning of the year until now has focused on certain stock codes and also partly reflects portfolio restructuring activities. In the coming time, Vietnam will be one of the markets that benefits when the trend of reducing interest rates, especially in the US, becomes clearer and stronger.

|

| Source: SSI Research |

The net selling value of foreign investors is at a low level

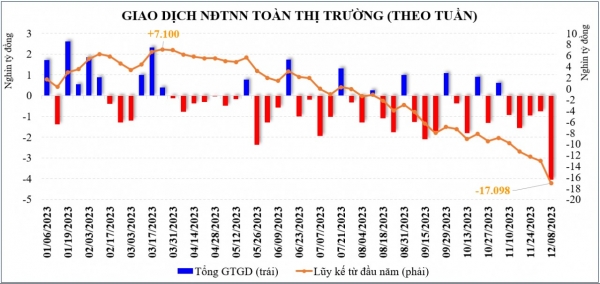

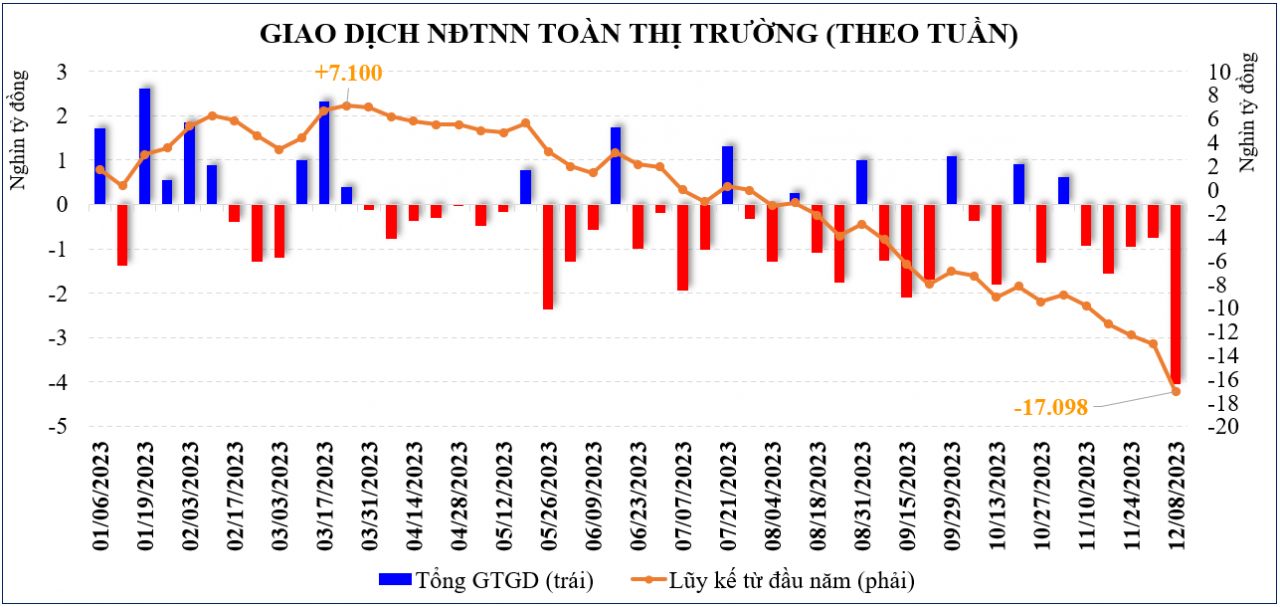

Unlike the positivity of domestic cash flow, from the beginning of the year until now, foreign investors have continuously been net sellers on the domestic stock market. Statistics from the beginning of the year, after the first quarter of net buying (about 7,000 billion VND), foreign investors have turned to net selling since the beginning of the second quarter until now. Statistics show that, from the beginning of the year to December 8, 2023, foreign investors have net sold with a relatively large value of about 17,000 billion VND. Net selling of foreign capital is also a common trend in many frontier and emerging stock markets because of the strong trend of increasing interest rates in developed markets.

However, talking to TBTCVN reporters, Ms. Hoang Viet Phuong – Director of the Center for Analysis and Investment Consulting, SSI Securities Company (SSI Research) said that, calculated in the first 11 months of 2023, the net sale value of foreign investors in the Vietnamese market is low compared to other markets. Specifically, in the Southeast Asia region, the outstanding net withdrawal trend in the Thai market is up to 5.4 billion USD compared to the net withdrawal in Vietnam (-554 million USD) and Indonesia (-877 million USD). ), Philippines (-855 million USD). Global investment cash flow in 2023 is strong in large markets such as the US and Japan and withdraws strongly in the Chinese market.

“A clear trend of foreign transactions, not only in Vietnam but in developing countries in general since mid-2023, is net withdrawal, when cash flows return to the US market (including including stocks, bonds or monetary funds)” – Ms. Phuong shared.

With a net selling value of nearly 13 trillion VND, in detail, foreign investors’ net selling is only locally concentrated in 3 codes: EIB (-5 trillion VND), VPB (-3 trillion VND) and MWG (-3.2 trillion VND). trillion). Meanwhile, on the contrary, foreign investors strongly net bought nearly 900 billion VND in the basic resources group in November and accumulated a net purchase of more than 6 trillion VND in this group since the beginning of the year. Foreign investors also continued to net buy other groups such as chemicals, construction materials and oil and gas in the last 2 months.

Explaining the reason for net selling by foreign investors, Ms. Hoang Viet Phuong said that in the Vietnamese market, strong net selling by foreign investors comes from the reversal of net withdrawals from ETF funds and the general net withdrawal trend of investment funds. Multinationals withdrew from emerging markets, while active fund groups in Vietnam only withdrew slightly net in the past 4 months.

“The cause comes from the difference in real interest rates between the US and the remaining countries, in addition to Vietnam’s monetary policy diverging from the US’s monetary policy and partly from profit-taking activities after the buying period. Strong net worth in 3 months of November 2022, December 2022 and January 2023, with a total value of up to 32.5 trillion VND. It can be seen that foreign investors’ net selling from the beginning of the year until now has focused on certain stock codes and also partly reflects portfolio restructuring activities” – SSI Research expert said.

Mr. Dinh Quang Hinh – Head of Macro and Market Strategy, Analysis Division, VNDIRECT Securities Company, also said: “The continuous net selling by foreign investors in recent times may stem from the last profit-taking move.” years and the movement of global capital flows.

Vietnam will benefit from a stronger reduction

|

Statistics from the beginning of the second quarter of 2023 until now, the proportion of foreign investors’ transactions has remained stable around the 8% threshold and it can be seen that the impact on the market is not large in terms of scores but only has a psychological impact on the market. Domestic individual investors caused the market to move cautiously for a long time.

From another perspective, Ms. Hoang Viet Phuong also said that foreign investors’ portfolio restructuring activities can create space for mid-term expectations of investment cash flow into the Vietnamese market when benefits return. from the trend of shifting to developing markets in the context of a clearer and stronger trend of interest rate cuts.

Regarding expectations in the near future, SSI Research experts say that currently the proportion of assets allocated to stock funds is at a level equivalent to the 5-year average (about 55%), showing that cash flow There is still room for a breakthrough in stocks, especially from restructuring from monetary funds (net inflows up to 1.3 trillion USD in 2023), if the trend of interest rate cuts from developed countries continues. , especially the US is clearer and stronger. At that time, emerging markets (and Vietnam) will certainly benefit somewhat.

The bright spots of Vietnam’s stock market will come from a stable macro environment (exchange rates and inflation are controlled), favorable monetary policy (interest rates are at historically low levels), and domestic consumption. There is still great potential for development when the population structure is still in the golden period and FDI capital flows are positive thanks to the shifting trend and advantages from the China +1 story.

Mr. Dinh Quang Hinh also said that in the context of strong net selling by foreign investors recently, the bright spot is the improvement of domestic cash flow in the context of the State Bank completing the return of all withdrawals. net from the system (full maturity of previously issued treasury bills). “With the current Government’s priority focusing on “economic growth”, the financial market in general and the stock market in particular will continue to benefit” – Mr. Hinh emphasized.

|

Create medium-term space for better foreign cash flow expectations “Foreign investors’ portfolio restructuring activities can create space for mid-term expectations when investment cash flows into the Vietnamese market benefit from the trend of shifting to developing markets in the coming years.” The context of the trend of interest rate cuts is clearer and stronger” – Ms. Hoang Viet Phuong – Director of SSI Research Investment Analysis and Consulting Center. |