(TBTCO) – According to Business Times, Techcombank is cherishing an attractive policy for shareholders. “The bank is considering long-term policy and mechanism options related to dividend distribution to shareholders and will submit it to the board of directors for approval” – Techcombank General Director Jens Lottner shared with this newspaper.

World economic fluctuations are causing significant pressure on Vietnam’s export-oriented economy. This year’s gross domestic product (GDP) is expected to grow at 5%, lower than the government’s target of 6.5%.

However, Mr. Lottner said the situation is gradually improving. “Believing in brighter prospects in 2024, Techcombank will focus on staying ahead of beneficial long-term trends in the market.” – he said.

Vietnam is a country with a young population with an average age of 33; The rate of people using smartphones is high and the number of rich people is among the fastest growing in the region and the world. “I believe that in the next 10 years, if everything goes well, Vietnam’s GDP per capita will be equivalent to China’s currently” – Mr. Lottner shared.

Aiming to serve domestic consumption

Established in 1993, Techcombank is one of the largest joint stock commercial banks in Vietnam, serving approximately 13 million individual and corporate customers. In 2018, this Bank officially listed on the City Stock Exchange. Ho Chi Minh.

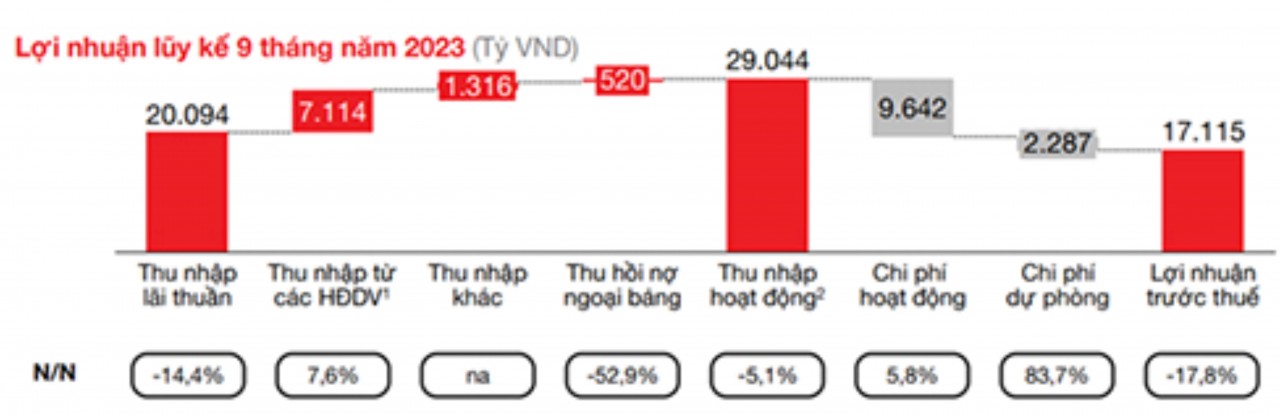

2023 is a challenging year for the Vietnamese banking system in general, including Techcombank when business results decline. As of September 30, although still the second most profitable joint stock commercial bank in the entire system, Techcombank’s pre-tax profit (PBT) for the first time recorded a decrease over the same period last year after many years of increase. tall. The bank recorded PBT of 17.1 trillion VND (equivalent to 944.2 million Singapore dollars), down 17.8%.

|

Total operating income decreased by 6.8% in the same period, to 29 trillion VND. Net interest income alone decreased by 14.4%, to 20.1 trillion VND.

|

However, Techcombank’s business activities have bright spots thanks to focusing on exploiting the rapidly growing middle-class customer segment and serving domestic consumer needs.

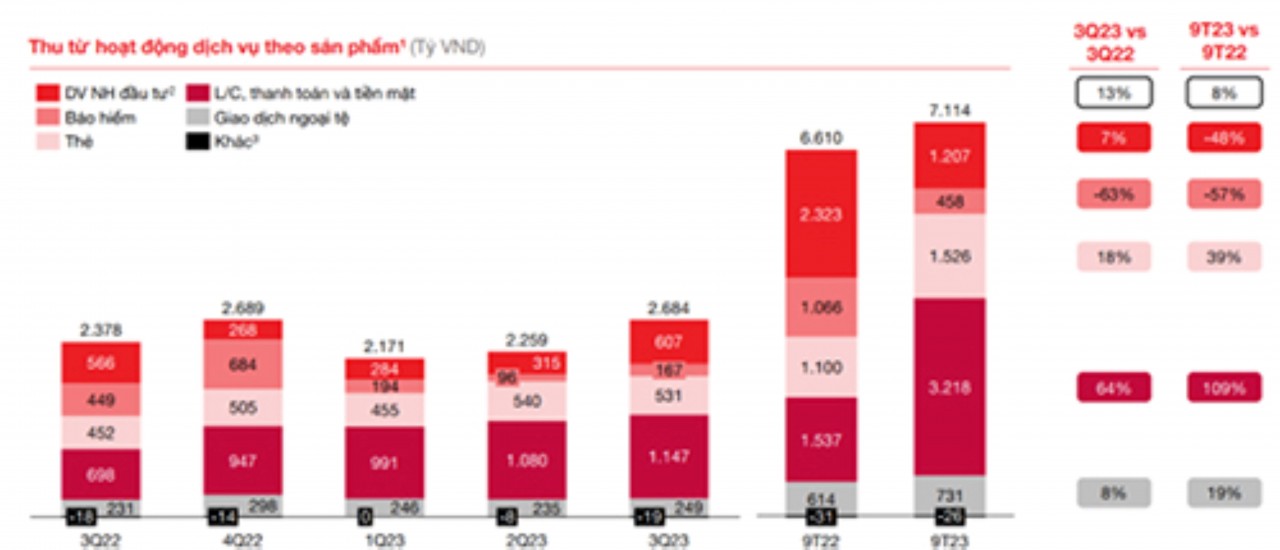

Specifically, the bank’s non-interest income in the first 9 months of 2023 increased by 16.1% to 9 trillion VND. Income from service activities increased 8% in the first 9 months of the year thanks to growth in credit card fees as transaction volume from consumer and installment activities continued to be high, as well as from L/C activities. C, payment & cash, serving the needs of businesses.

Mr. Lottner also sees potential in serving a younger, tech-savvy customer base through partnerships and customer appreciation programs.

From 2021, Techcombank cooperates with retail giant – Masan to provide cashless payment services and incentive programs at the Winmart convenience store chain. Specifically, for the first bill, customers who are Win members and register to open a new Techcombank account will receive a 50% discount (maximum 100,000 VND) when paying by non-cash method.

|

Techcombank identifies great potential from serving young, technology-savvy customers through partnerships and customer appreciation programs.

|

Thanks to investment in digitalization, Techcombank’s customer file has expanded. In the first 9 months of 2023, the Bank added 2.2 million new customers, of which 44.4% were attracted through digital channels and 42.9% were attracted through the partner ecosystem.

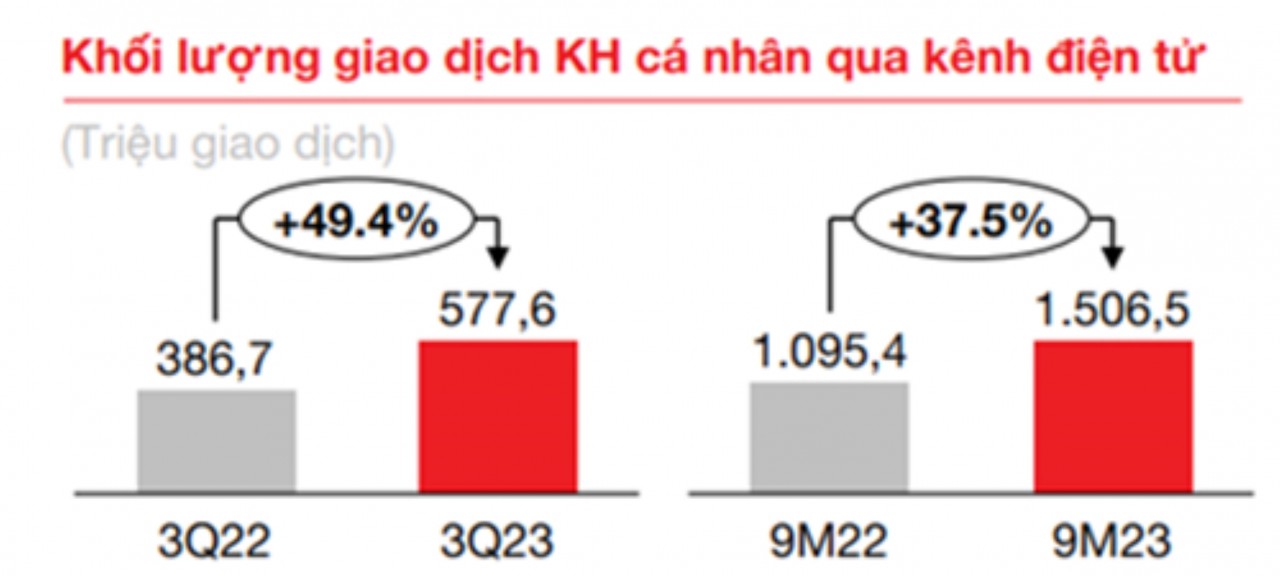

In the third quarter, the transaction volume of individual customers made through electronic banking channels also grew dramatically, reaching nearly 50% to 577.6 million transactions.

Accumulated in the first 9 months of 2023, this number increased by an impressive 37.5% over the same period, to 1.5 billion transactions, accounting for nearly 94% of the total number of transactions of individual customers.

“Previously, we attracted customers mainly through branch channels, however, now, Techcombank has the ability to open new customer accounts in just a few minutes through digital channels. Thanks to that, customer service costs are optimized by 10 to 20 percentage points” – Mr. Lottner said.

|

| Volume of individual customer transactions via electronic channels |

Expand the portfolio of small and medium enterprises

In terms of lending, this year Techcombank focuses on expanding its corporate customer portfolio. However, the larger strategy that this bank pursues is to shift its credit portfolio from large corporate customers to individual customers as well as small and medium enterprises (SMEs).

| The larger strategy that Techcombank pursues is to shift its credit portfolio from large corporate customers to individual customers as well as small and medium enterprises (SMEs). |

Techcombank specifically focuses on financing SME (small and medium-sized) enterprises serving domestic consumption, such as agricultural products, instead of businesses operating in import-export-oriented fields such as manufacturing.

He also shared: “Perhaps our direction is a little different from normal expectations…We focus on areas associated with or driven by domestic consumption growth.”

Techcombank is building a dividend mechanism and policy

According to domestic media, Techcombank is cherishing an attractive policy for shareholders. This bank has not paid cash dividends in the past decade. However, during the 2023 general meeting of shareholders in April, Techcombank Chairman mentioned “there may be changes”.

Sharing about this issue, Mr. Lottner said: “Ten years ago, we decided not to pay dividends to retain capital to expand our business operations. Up to now, the position and capacity of the bank is very different, much stronger than 10 years ago. Techcombank is building a long-term mechanism and policy related to paying dividends to shareholders because the bank now has the ability to both pay dividends and ensure reinvestment in business stability and continued growth.”

| Techcombank’s good growth has attracted the attention of domestic and foreign analysts. Many foreign investors are increasing their holding of stocks instead of selling them. |

According to him, the bank is considering options and will submit them to the board of directors for approval. Techcombank’s good growth as well as positive business results have attracted the attention of domestic and foreign analysts. In a report dated August 14, recalling the end of October, Maybank listed Techcombank among the top domestic banks with stocks worth investing in and issued a “Buy” recommendation with a target price of 48,700 VND. Techcombank’s stock price at the end of the trading session on November 24 was 30,050 VND, according to data from Bloomberg.

According to Maybank’s estimates, by 2023, Techcombank’s stock price is not reflecting the actual value, with a price/book value ratio (P/B) of only 0.9x, lower than the industry average. is 1.4x.

“At this price, Techcombank shares are one of the stocks worth investing in and holding in the period 2023 – 2025. The recovery of the real estate market along with strong growth forecast for 2024 These are factors that will contribute to making Techcombank’s stock price more accurately reflect its real value in the near future” – Mr. Lottner commented.

In addition, according to Mr. Lottner, foreign investors are very interested in Techcombank shares, but the foreign ownership ratio is a big barrier. “A lot of foreign investors are hoarding stocks instead of selling. Techcombank shares are currently very difficult to buy.”

Rumors of a cash dividend also increased investor interest in this bank’s shares, but Mr. Lottner emphasized that Techcombank still prioritizes a cautious approach.

| “We aim to deliver long-term value to shareholders. Instead of just creating events that cause temporary excitement, Techcombank aims to build a sustainable value chain” – Mr. Lottner shared. |