(TBTCO) – Futures contracts closed completely in the red on the derivatives market on December 13. The decrease in contracts is influenced by the underlying market, but the amplitude of the decrease is less. Liquidity improved slightly but at a low average level.

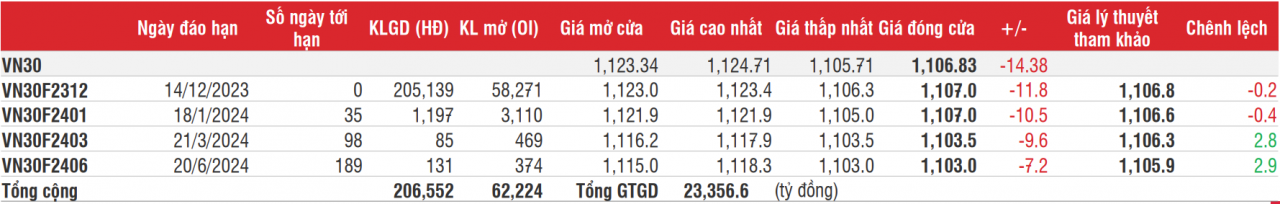

On the derivatives market on December 13, futures contracts closed completely in the red. Selling pressure gradually increased towards the end of the afternoon session on the base market, also causing the side that opened a Short position to increase activity in the derivatives market. Even so, contracts fell slightly compared to the underlying index. Accordingly, futures contracts decreased from -7.2 points to -11.8 points; Meanwhile, the base index is -14.38 points.

|

| Derivative market liquidity improved slightly but at a low average level. Accordingly, the total futures contract trading volume reached 206,552 contracts. |

The current monthly contract VN30F2312 decreased -11.8 points and ended the session at 1,107 points. The decrease in the December contract is lower than the base index, so the positive gap is equal to +0.17 points. This is also the status of contract VN30F2401; The remaining 2 longer-term contracts still maintain a negative difference.

Derivative market liquidity improved slightly but at a low average level. Accordingly, the total futures contract trading volume reached 206,552 contracts, with the current month contract alone reaching 205,139 contracts.

|

| Technical chart of contract VN30F2312. |

On the 1-hour technical chart, the VN30F2312 contract reversed when approaching the short-term upper trend line at 1,123 – 1,125 points. Technical indicators such as the strength index (RSI) and moving average convergence divergence (MACD) all show short-term correction signals.

According to SSI Research, the VN30F2312 contract will maintain this trend and move towards the short-term target at 1,093 – 1,094 points. It is recommended that investors can open a short-term position at 1,107 points, cut loss above 1,110 points and take profit at 1,095 -1,096 points.

On the base market, the VN30 index decreased -14.38 points (-1.28%) and closed at 1,106.83 points. Trading volume increased again with 190.6 million units matched. The resistance threshold of 1,124 points stopped the increase, while strong selling pressure caused a reversal in the VN30. Technical indicators such as RSI and trend indicator (ADX) both show weak neutral signals. Thus, the VN30 index will maintain its short-term downtrend and move towards the 1,092 – 1,094 point range./.