(TBTCO) – On the domestic foreign exchange market last week, the VND/USD exchange rate was mainly sideways. As for interbank interest rates, overnight interest rates continued to cool down and ended the week at 0.15% – down 15 basis points compared to the previous week and back to the same level as in mid-September.

The difference between listed and free exchange rates widened

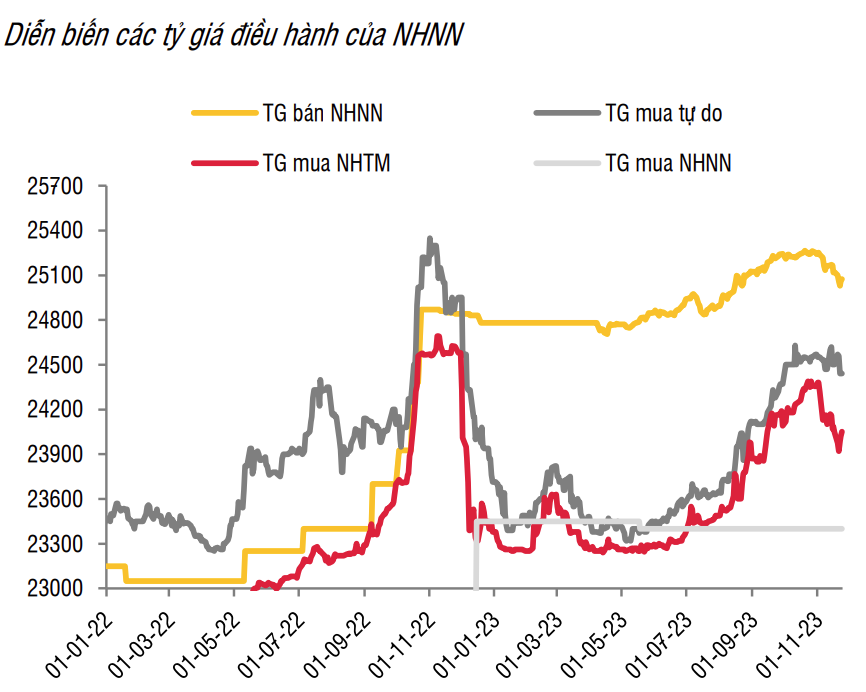

SSI Research’s money market report last week said that in the domestic foreign exchange market, the VND/USD exchange rate was almost flat. Accordingly, the interbank exchange rate ended the week at 24,270 VND/USD, equivalent to the previous week. Similarly, VCB’s listed exchange rate closed around 24,050 – 24,420 VND/USD. On the contrary, the exchange rate on the free market has the opposite trend, increasing sharply in the first half of the week and gradually cooling down towards the end of the week.

However, in the first session of this week, the exchange rate on the free market continued to increase and the difference between the listed and free exchange rates widened to over 200 VND/USD – creating pressure on speculative cash flow between the two markets. this school. According to the explanation of SSI Research experts, fluctuations in free market exchange rates may be related to gold price fluctuations – when world gold prices increase sharply, it can create expectations that domestic gold prices will also increase. similar sharp increase adjustment step.

|

Meanwhile, on the international market last week, the US Federal Reserve (FED) announced the minutes of its meeting in early November, without much surprising information for the market. Accordingly, the Fed’s FOMC emphasized that it will continue to operate carefully and closely monitor economic and inflation data in the future. As for economic figures, data shows that the US economy still records positive growth inertia.

Regarding the fluctuation of the USD (through the DXY index), DXY decreased slightly (-0.5%) and helped key currencies increase in value compared to the USD such as: GBP +1.1%, EUR +0.2 %, or JPY +0.1%. For regional currencies, CNY (+0.9%) recorded the strongest increase in price compared to USD thanks to the release of consumption data on November 11 and recorded improvement compared to USD. with the same period.

Interbank interest rates dropped sharply

Also according to SSI Research’s report, in the past week, the open market operations channel did not conduct new transactions. Therefore, with 25.5 trillion VND of T-bills maturing, the total volume of T-bills outstanding in the market decreased to 73.2 trillion VND.

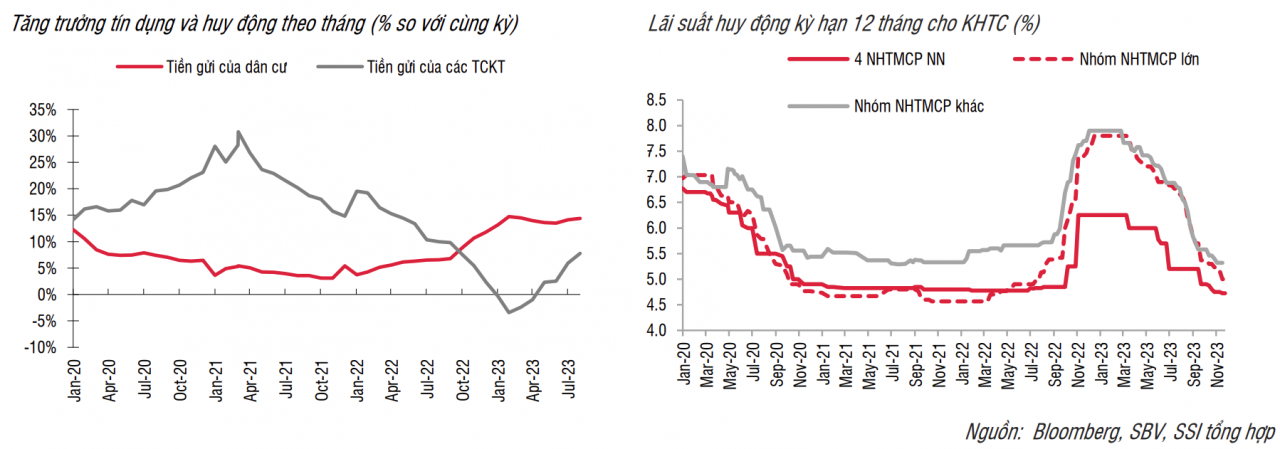

| Resident deposits recorded an increase of 14.4% over the same period – the highest growth rate since 2017. Deposit growth of economic organizations after bottoming out in March 2023 has also increased. returned and increased by 7.8% over the same period. |

Regarding interbank interest rates, overnight interest rates continued to cool down and ended the week at 0.15% – down 15 basis points compared to the previous week and returned to the same level as in mid-September. before the State Bank carries out the bill issuance operation. The difference between VND-USD overnight interest rates has widened to nearly -500 basis points.

|

According to new data released by the State Bank, capital mobilization growth as of the end of September reached 7.28% compared to the end of 2022, equivalent to an increase of 11% over the same period. In particular, deposits from residents recorded an increase of 14.4% over the same period – the highest growth rate since 2017. Deposit growth of economic organizations after bottoming out in March 2023 also rebounded and increased by 7.8% over the same period.

In contrast, credit growth has remained virtually unchanged since April 2023 (up about 9.6 – 9.9% over the same period) and the credit – capital mobilization gap has narrowed to only minus 75 trillion VND – from nearly 300 trillion VND in April 2023./.