(TBTCO) – Gold prices have just entered a period of strong fluctuations recently. According to observers, the increase in gold prices is also in the general context of world prices, and is also influenced by the recent sharp decline in interest rates. However, surfing gold also contains many risks, so investors need to be very cautious.

|

External factors

In the last week of November, world gold prices recorded a continuous upward trend despite a previous period of impressive increase. Specifically, on November 27, the spot gold price was only 2,004.4 USD/ounce, but increased steadily in the following days and sometimes reached 2,044 USD/ounce. As of the morning of December 1, Vietnam time, the world gold price has adjusted slightly down, but is still at a fairly high level at 2,042 USD/ounce.

Currently, the political and economic situation in the world has many moves that can have opposite impacts on gold prices. Normally, as a rule, the expectation of an end to military conflicts can easily lead to a reduction in the need to accumulate gold (to hedge risks), which can easily cause gold prices to fall.

However, the fact that the ceasefire between Israel and Hamas took place did not make the gold market less attractive, but gold prices have still increased in recent days.

However, the financial market also faces many other factors that can impact gold prices. The DXY index, which measures the strength of the USD, is still in a rather weak state, which can be considered one of the factors that make gold more valuable in comparison with the USD because the international gold market is often listed according to the index. this coin.

In addition, the cooling inflation situation in the US also makes investors expect that the US Federal Reserve (FED) will stop the series of interest rate increases that have lasted for the past 2 years and may even consider reducing interest rates. in early or mid-2024.

Accordingly, when interest rates in the US shift into a downward cycle, it will be a factor that creates a shift in capital flows from financial instruments with fixed interest rates to other investment channels, usually stocks and gold.

US Department of Labor data released on November 14 showed that US CPI increased by 3.2% over the same period last year. This speed is down from 3.7% in September and slower than economists’ forecasts. Compared to the previous month, CPI did not increase.

On Kitco, some financial experts predict that gold will have a positive outlook in 2024. However, there are also analysts who believe that although inflation in the US has cooled down, it is still much higher than in the past. The expected level is 2%, so the possibility that the FED will loosen monetary policy will not happen soon.

Heat transfer to domestic market

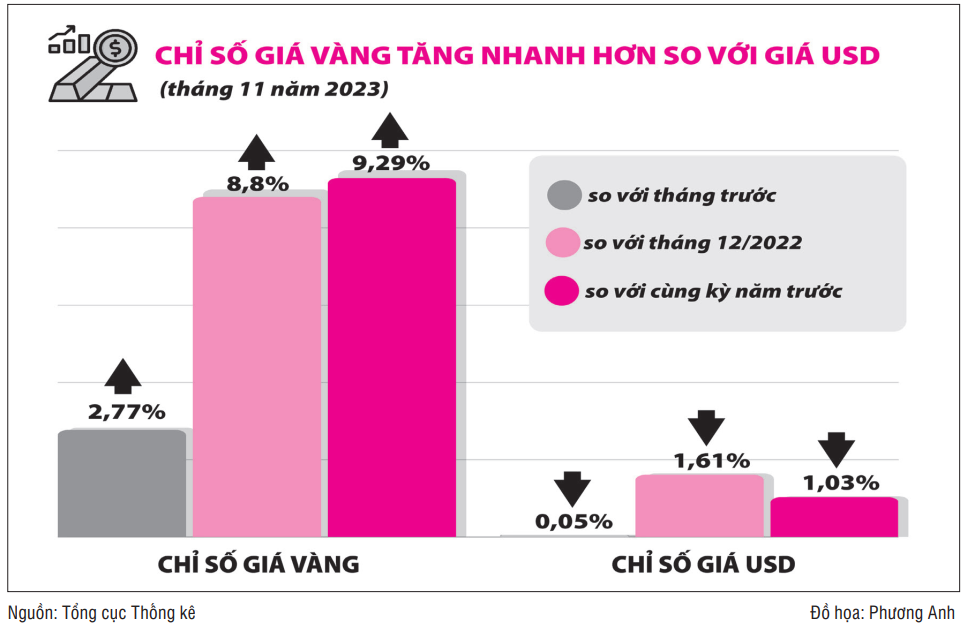

The heat of the world gold market has also transferred heat to the domestic gold market, with an impressive upward trend in prices and the highest record ever, when the sale of SJC 9999 gold bars has at times surpassed historical milestone of 74 million VND/tael.

At the end of the week, although the gold price has cooled down a bit, the price level is still very high. On the morning of December 1, the buying/selling price of SJC 9999 gold bars was 72.4/73.6 million VND/tael. and SJC 9999 gold ring is 61.25/63.25 million VND/tael.

In addition to external influences, the domestic gold market also has more favorable factors than the international market. Specifically in the international market, although the FED is temporarily suspending interest rate increases, it still hangs interest rates at a high level and when the interest rate reduction will take place is still only based on predictions with incomplete factors. sure.

|

| The heat of the world gold market has also transferred heat to the domestic gold market. Photo: TL |

Meanwhile, interest rates in the Vietnamese market have continuously decreased in recent times and currently deposit interest rates are lower than the interest rates before the Covid-19 epidemic. The 1-year term interest rate at Vietcombank is currently only 4.8%/year. Meanwhile, the real estate market is still facing many risks, while the general business situation of businesses is still not completely favorable to attract cash flow into businesses’ stocks.

In this context, gold becomes the remaining investment channel that investors can think of. According to economic expert Nguyen Tri Hieu, gold is currently a safe and attractive haven at this time.

However, investors also need to be very careful, because gold prices can fluctuate rapidly in a short period of time. During this period, investors must monitor gold market developments continuously, even hourly, to promptly grasp the market.

Meanwhile, Mr. Huynh Trung Khanh – Vice Chairman of the Vietnam Gold Business Association, said that gold may have factors to increase the price, but Mr. Khanh also advised people to be cautious when making decisions to buy or sell. gold because buying and selling gold for surfing will be very risky.

In fact, the recent price listing actions of gold companies show that, when gold prices are stable, the difference in buying price/price of SJC 9999 gold is usually at 1 million VND/tael. Meanwhile, at times when gold prices fluctuate strongly as in recent days, gold companies have widened the difference in buying/selling prices, for example with SJC 9999 gold it is about 1.2 to 1.22 million VND. /quantity.

This shows that transaction costs for investors who need to buy and sell short-term have also increased compared to before. Therefore, with this property, even at some times, although the price of gold increases – but does not increase more than the buying/selling difference – investors will not make a profit if short-term surfing.

“Gold is currently a safe and attractive haven at this time. However, investors also need to be very careful, because gold prices can fluctuate rapidly in a short period of time. During this period , investors must monitor gold market developments continuously, even hourly, to promptly grasp the market.” Mr. Nguyen Tri Hieu – economic expert. |