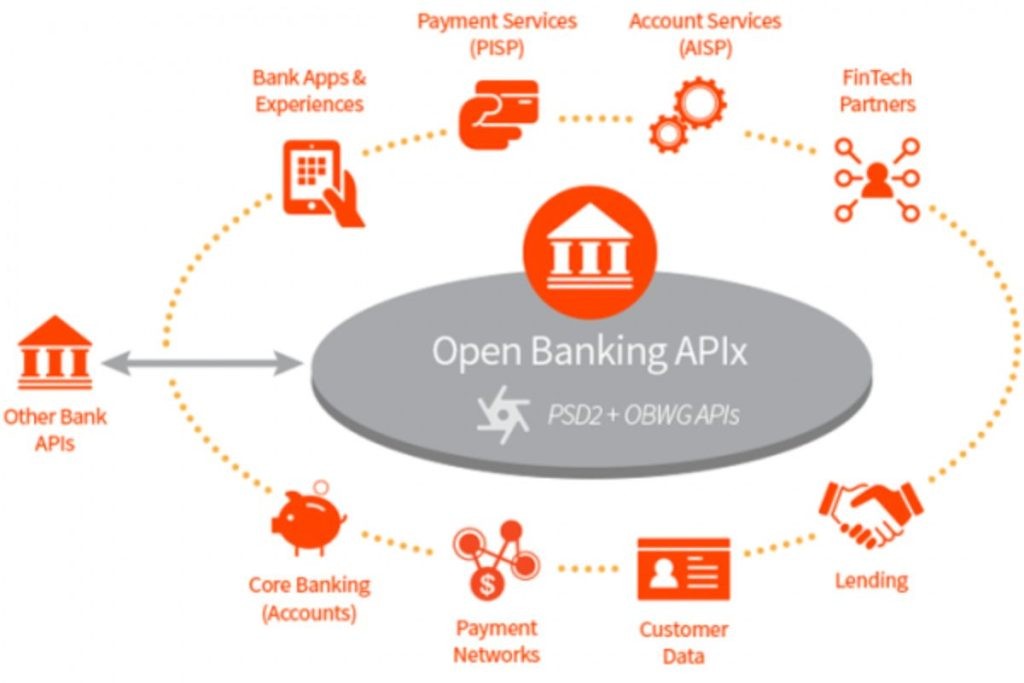

(TBTCO) – According to the State Bank of Vietnam, up to now, 72.3% of banks have been planning to deploy APIs (application programming transactions), of which 47.6% have built APIs for customers. third party connection.

In addition, currently about 65% of banks are ready to deploy Open API (open application programming), of which over 30% of banks and credit institutions have a high level of readiness for Open API.

|

| Nearly 50% of banks have API systems for third parties to connect. Photo: TL |

| The State Bank loosens credit “room” for some banks. There will be new regulations on the National Interbank Electronic Payment System |

In the last 2 years, many banks have proactively shifted their business model from traditional to the trend of communicating with customers through online windows. This is gradually eliminating the separation of space, time and physical context. This is the basis for the banking industry to move further in the process of converting to open banking in a comprehensive, strong and rapid way.

Regarding practical applications, recently some banks have deployed non-cash payment solutions for hospitals, schools, and online tax payment from the Etax application. Some other services include taxi payment from 3rd partner applications, debt repayment, loan settlement, salary payment…

According to the State Bank, technically, in order for digital transformation to develop, the banking industry must connect all economic sectors. That means, knowledge about Open Banking and Open API not only applies to the banking industry but must also be applied in all economies.

Legally, this activity also needs to complete guidelines on legal conditions to be able to use the bank’s API; Develop appraisal, certification, licensing and inspection units for third parties licensed to use the bank’s Open API…/.