(TBTCO) – At the beginning of this morning’s trading session, the domestic and world gold markets both adjusted and increased sharply. Gold saw its fourth consecutive session gain and reached its highest level in more than a month. Experts say that in the short term, gold prices will still increase.

|

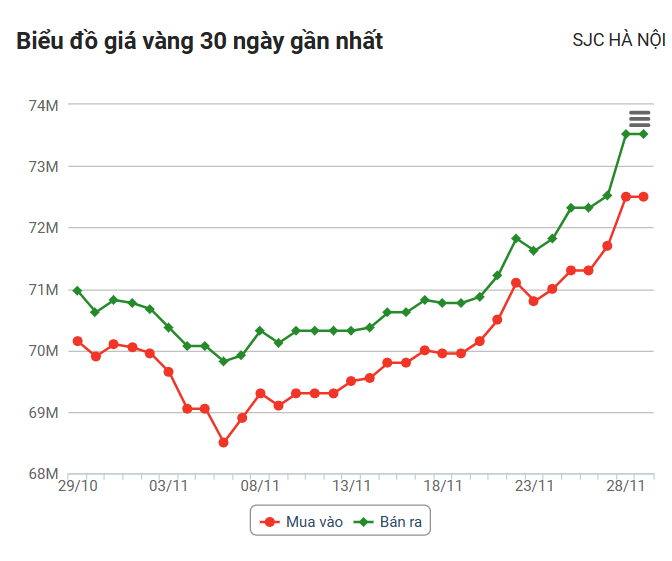

| Source: Rong Viet Online Services Joint Stock Company VDOS – Updated at 06:24 (November 29, 2023) |

World market

Survey at 5:00 a.m. (Vietnam time), according to Kitco, spot gold price was at 2,039.66 USD/ounce, a difference of 26,695 USD/ounce compared to yesterday’s price.

Spot gold increased 1.4% at approximately 2,040 USD/ounce, the highest since May 10.

Gold rose for a fourth consecutive session and hit its highest level in more than six months, on the back of a weaker dollar and expectations that the US Federal Reserve (FED) has completed its interest rate hike.

Converted at the current exchange rate at Vietcombank, world gold costs about 58,938 million VND/tael (excluding taxes and fees). Thus, SJC’s gold bar price is still higher than the international gold price of 13,562 million VND/tael.

In other metals markets, silver rose 1.4% to $24.97 an ounce, platinum rose 2.3% at $939.80. Palladium fell 1.4% to $1,055.59 an ounce.

Domestic market

Along with the increase in world gold prices, at 5:30 a.m. this morning, on the trading floors, prices were also adjusted by brands to increase from 700,000 VND to 1.15 million VND/tael.

In particular, the adjustment of 700 thousand VND/tael (buying) belongs to SJC gold of Bao Tin Manh Hai.

Level of 1.15 million VND/tael (sold) – the highest adjustment level belongs to JSC gold of the Mi Hong brand.

Specific prices of the brands are listed as follows:

DOJI’s 9999 gold is listed at 72.3 – 73.50 million VND/tael (buy – sell), up 800 thousand VND/tael on the buying side and 1 million VND/tael on the selling side.

SJC gold in Hanoi was listed at 72.5 – 73.52 million VND/tael (buy – sell) with an increase of 800 thousand VND/tael on the buying side and 1 million VND/tael on the selling side.

PNJ brand listed at 72.6 – 73.6 million VND/tael (buy – sell) increased by 1 million VND/tael on the buying side and 1,100 million VND/tael on the selling side.

Vietinbank Gold’s SJC gold is listed at 72.5 – 73.52 million VND/tael (buy – sell), an increase of 800 thousand VND/tael on the buying side and 1 million VND/tael on the selling side.

SJC gold price at Bao Tin Minh Chau Co., Ltd. was also traded by businesses at 72.50 – 73.45 million VND/tael (buying – selling), an increase of 740 thousand VND/tael on the buying side and 1,020 VND/tael. million VND/tael on the selling side.

At Bao Tin Manh Hai, this brand’s gold is listed at 72.4 – 73.72 million VND/tael (buying – selling), an increase of 700 thousand VND/tael on the buying side and 1 million VND/tael on the outside. Afternoon sale.

At Mi Hong Jewelry Company, the gold price here is listed at 72.6 – 73.6 million VND/tael (buying – selling), increasing by 950 thousand VND/tael on the buying side and 1,150 VND/tael. million VND/tael on the selling side.

Forecast

Jim Wyckoff, senior analyst at Kitco Metals, said the near-term outlook for gold remains optimistic, with the dollar index in a bearish trend on hopes the Fed will not raise interest rates again and may even interest rate cuts in the spring.

“However if (US) GDP and inflation figures are stronger than expected, that will dampen traders’ enthusiasm for bullion,” Wyckoff added.

Fed policymakers are increasingly comfortable ending the year with interest rates on hold and waiting before cutting. Lower interest rates reduce the opportunity cost of holding interest-free bullion./.