(TBTCO) – The stock market today (December 13) was under strong profit-taking pressure in the afternoon session after failing to successfully break through the November peak. Selling pressure occurred on a large scale and this was also the sharpest drop in the session. The last 3 weeks. The downward momentum comes from the strong net selling impact of foreign investors.

Selling pressure increased at the end of the session

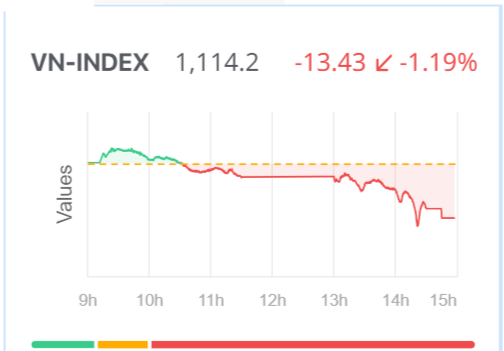

On the stock market today, the sideways trend with a narrow amplitude on a low liquidity basis continued to be maintained this morning, even at one point the VN-Index exceeded the threshold of 1,131 points. Selling pressure at the peak in November along with portfolio restructuring activities of ETF funds caused the market to drop quite sharply in the afternoon session, especially when it lost the support threshold of 1,120 points.

Closing today’s trading session, the VN-Index decreased -13.43 points, to 1,114.2 points. Statistics on HOSE, today only 89 codes increased, 70 codes remained unchanged, while there were 448 codes decreased. Regarding stock groups, the downward pressure is widespread so there is no stock group going upstream today, the decline is mainly concentrated in pillar stocks.

|

| Major stocks that put pressure on the market this session include: HPG (-2.15%), GAS (-1.66%), VCB (-0.59%), VNM (-1.73%) , FPT (-1.65%)… On the contrary, large stock groups supported the market including: HAG (+3.44%), LGC (+3.69%), BVH (+1%) , VJC (+0.48%), PGD (+4%)… |

The VN30 group also interrupted the chain of increases for 5 consecutive sessions. Closing today’s session, the VN30 index decreased -14.38 points (-1.28%), to 1,106.83 points. Market breadth recorded 3 codes increasing, while 27 codes decreased. Stocks such as: HPG, FPT, TCB, VPB, STB… became a drag for this group of stocks.

On the Hanoi floor, two main indexes also adjusted downward. Meanwhile, the HNX-Index retreated -3.29 points (-1.42%), closing at 228.42 points; UPCoM-Index also lost -0.26 points (-0.3%) to 85.09 points.

Market liquidity reached 21,394 billion VND, an increase of 34.5% compared to yesterday’s session. According to statistics, liquidity in 3 sessions this week is 25.6% lower than the average level last week.

Foreign investors continued to net sell VND 901 billion on HOSE. In particular, the selling force focused on codes, including: VNM (-129 billion VND), STB (-81 billion VND), HPG (-64 billion VND), VHM (-48.6 billion VND)… Meanwhile , foreign investors were net buyers on the HNX with a value of +61.5 billion VND.

Depends on the actions of the party holding the money

Today’s market correction is actually not too strong. However, the market is used to fluctuating in a narrow range and today the range has been widened, creating a feeling of disappointment. That combined with the portfolio restructuring session of ETF funds created more selling pressure towards the end of the session.

|

| Selling pressure gradually increased towards the end of the session. Illustration. |

Market liquidity increased well today. The matched order value on HOSE reached more than 16 trillion VND, which is quite good. That means there are still buyers when prices drop sharply. Of course, it is possible that the sellers will continue because the selling force cannot be exhausted immediately.

The rest depends on the actions of the party holding the money. Because falling prices always create opportunities in the context of the market entering the year-end period. The market in general is not too bad, the current trend is still struggling to accumulate, opportunities at the end of the year may be better when the macro context is forecast to be positive.

Technically, the Vn-Index has not yet succeeded in surpassing the peak in November. The next decline (if any) will bring this index into a model of 2 small peaks, which may be a signal that makes investors Investors sold more at the end of this afternoon’s session.

However, one down session is not enough signal to confirm this model. An unsuccessful breakout at the peak is normal and the market may continue to fluctuate in a sideways range from November to next. now within range: 1,075 – 1,130 points. As long as the margin below 1,075 points is not violated, the market is still able to maintain the existing sideways trend./.